Answer a few questions to find the right policy for you, fast. Or, an expert, state-licensed VIU by HUB Advisor can get you insured in a snap.

Homeowners insurance keeps your family, house and belongings protected against unforeseen events like natural disasters, injury, theft and beyond.

Homeowners insurance provides coverage for damage to your home and personal property, as well as liability coverage for certain incidents that occur on your property.

Homeowners insurance covers your investment in your home and personal belongings by providing financial protection against damage, theft and liability. It’s not necessary by law, but if you have a mortgage on your property, your lender will typically require it.

Risks, requirements and legal specifics vary by state, so it’s best to read up on the particulars related to where you live. VIU by HUB offers insurance options and information for all 50 states.

Read “Home renovation projects: Getting the right insurance and contracts”

Standard homeowners insurance policies generally include coverage for the structure of your home, personal belongings, liability protection and additional living expenses incurred if a covered loss renders your home temporarily uninhabitable.

Ideally, your home insurance coverage limits should be high enough to cover the cost of rebuilding your home and replacing your personal belongings in the event of a total loss. A VIU by HUB Advisor can help determine how high your limits should be, including cost considerations associated with potential liability claims.

Standard homeowners insurance policies typically do not cover flood or earthquake damage. Flood Insurance is available through the Federal Emergency Management Agency’s National Flood Insurance Program. Depending on your needs, a VIU by HUB Advisor can get you coverage against flooding as well as earthquakes and hurricanes.

Standard homeowners insurance policies have limits for certain types of valuables. For high-value items, you might need additional coverage or endorsements. A VIU by HUB Advisor can make sure to include specialized coverage for any valuables you may have.

Most standard homeowners insurance policies include other structures coverage, but it's always good to double check. When reviewing your policy or shopping for a new one, a VIU by HUB Advisor can make sure this coverage is included in your plan.

Homeowners insurance policy rates generally depend on the value and age of the home, deductible amounts, coverage limits and other factors like location specifics.

Read “Surprising things that lower your homeowners insurance”

Many insurers offer discounts for being claim-free or if you have certain safety measures in place like smoke detectors, fire extinguishers, security cameras, burglar alarms, or deadbolt locks. When purchasing a policy through VIU by HUB, an advisor will be sure to apply any available discounts before you make your first payment.

Read “Surprising things that lower your homeowners insurance”

After you file a claim and report a loss, an insurance adjuster will come to inspect the damage and determine how much your insurance company should pay for the repair or replacement.

It's wise to review your policy annually or whenever you make significant changes to your home or belongings. VIU by HUB Advisors always look out for your best interests, so whether you’re looking to switch carriers, add coverages or need help getting insured for the first time, we’ll be sure to find you the protection you need at the best possible rate.

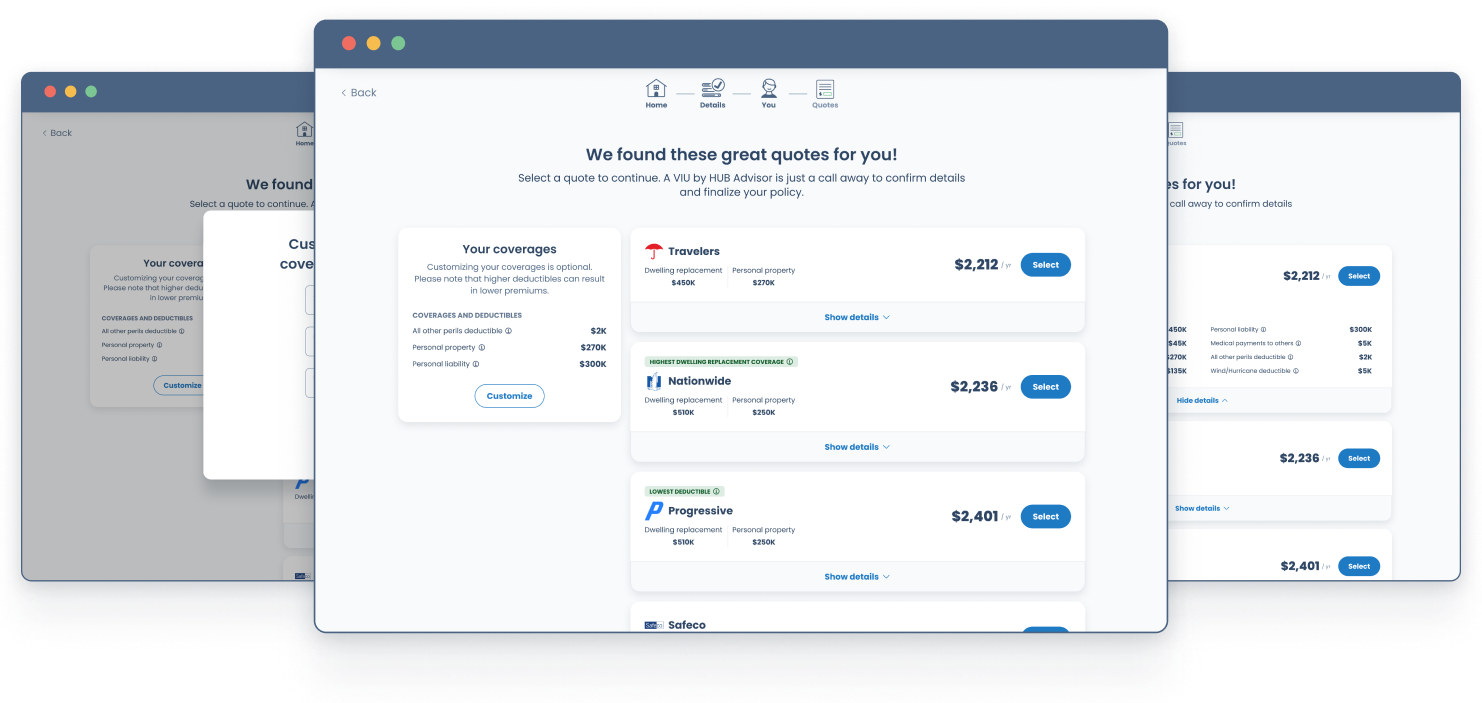

Compare relevant insurance quotes faster than ever.

Lean on experienced VIU by HUB Advisors for guidance and peace of mind.

The VIU Point is here to help you make sense of it all, so you can confidently compare homeowners insurance quotes and make the best policy decisions.