Answer a few questions to find the right policy for you, fast. Or, an expert, state-licensed VIU by HUB Advisor can get you insured in a snap.

Auto insurance protects you against significant financial loss in the event of an accident or if someone steals your vehicle.

Auto insurance is a contract between you and an insurance company that provides financial protection against physical damage, bodily injury and liability resulting from accidents.

Auto insurance provides financial protection in the event of accidents or theft. Most jurisdictions require basic coverage for drivers to legally operate a vehicle. Risks, requirements and legal specifics vary by state, so it’s best to read up on the particulars related to where you live. VIU by HUB offers auto insurance options and information for all 50 states.

Common auto insurance coverages are liability, collision, comprehensive, uninsured/underinsured motorist, medical payments and personal injury protection.

Read "Auto accident coverage and adding additional coverage”

Auto insurance rates are determined by various factors like the driver’s age, driving history, location, type of car and levels of coverage.

Read “How to compare car insurance quotes”

Read “How telematics could lower your auto insurance premium”

If you’re found to be at fault in an accident, your liability coverage will pay for legal fees and the other party’s property damage and medical expenses, up to your policy limits. This may also lead to an increase in your auto insurance rates.

Read “Injury, information, insurance: What to do after a hit and run”

Adding or removing someone from your auto insurance policy is easy to do, but it may impact your rates. An advisor or carrier rep can get that sorted out for you in no time.

After filing an auto insurance claim, your insurer will assign a claims adjuster to investigate. They'll review any police reports, inspect vehicle damage, interview involved parties and determine fault. Depending on their findings, you'll receive a settlement offer covering repairs, replacements or medical expenses as applicable. If you agree, you'll be compensated; if not, you can negotiate. If you’re found to be at fault, your premiums might increase at the next renewal; if another party was responsible, your insurer might seek reimbursement from them or their insurance provider.

We recommend reviewing your auto insurance policy annually, around when renewal periods occur, or when you go through a life change like:

VIU by HUB Advisors always look out for your best interests, so whether you’re looking to switch carriers, add coverages or need help getting insured for the first time, we’ll be sure to find you the protection you need at the best possible rate.

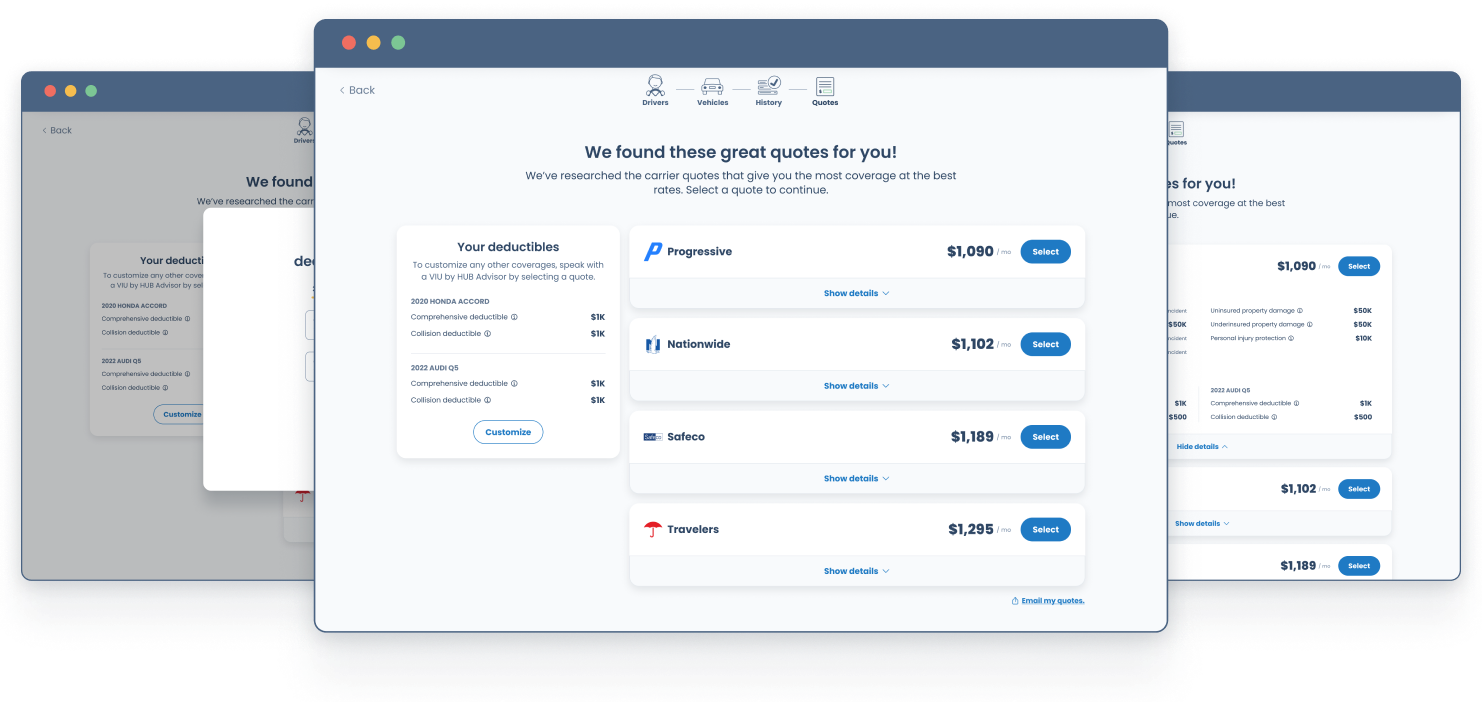

Compare relevant insurance quotes faster than ever.

Lean on experienced VIU by HUB Advisors for guidance and peace of mind.

The VIU Point is here to help you make sense of it all, so you can confidently compare auto insurance quotes and make the best policy decisions.