Answer a few questions to find the right policy for you, fast. Or, an expert, state-licensed VIU by HUB Advisor can work with a carrier to get you insured in no time.

Find the most relevant landlord insurance quotes for your property and stay covered against damages, loss of income, personal liability and more.

The VIU Point blog is here to help you confidently compare landlord insurance quotes and make better policy decisions overall.

A landlord insurance policy typically covers property damage, loss of rental income and liability if a tenant or guest is injured on the property. A VIU by HUB Advisor can walk you through any details as well as additional coverage options like rent guarantee insurance, natural disaster coverage, employer's liability (if you employ someone who works on the property) and legal expense coverage.

A homeowners insurance policy is designed for properties where the owner resides, while landlord insurance is meant for properties that are rented out to tenants. Landlord policies provide coverage for loss of rental income, which homeowners policies typically don’t. They might also offer broader liability coverage, taking into account that renters occupy the property. Finally, a landlord policy generally only covers the building’s structure and any appliances or furnishings owned by the landlord, but not the tenants' possessions.

While landlord insurance isn't typically mandated by law, the amount you should have depends on the value of the property, potential rebuilding costs, the level of liability risk you're willing to assume and the requirements set by your mortgage lender. A VIU by HUB Advisor can help determine the right amount of coverage for your situation.

If you regularly rent out your property on platforms like Airbnb, traditional homeowner's insurance might not provide sufficient coverage. While Airbnb does offer a "Host Guarantee" and "Host Protection Insurance," these do not replace the need for your own insurance because there may be gaps in what Airbnb's coverage offers and what actually happens.

Some homeowners policies might exclude short-term rentals from coverage, meaning you’d be unprotected if a claim arose during an Airbnb guest’s stay. If you're an Airbnb host or considering becoming one, you may need landlord insurance or a policy specifically designed for short-term rentals. A VIU by HUB Advisor can help.

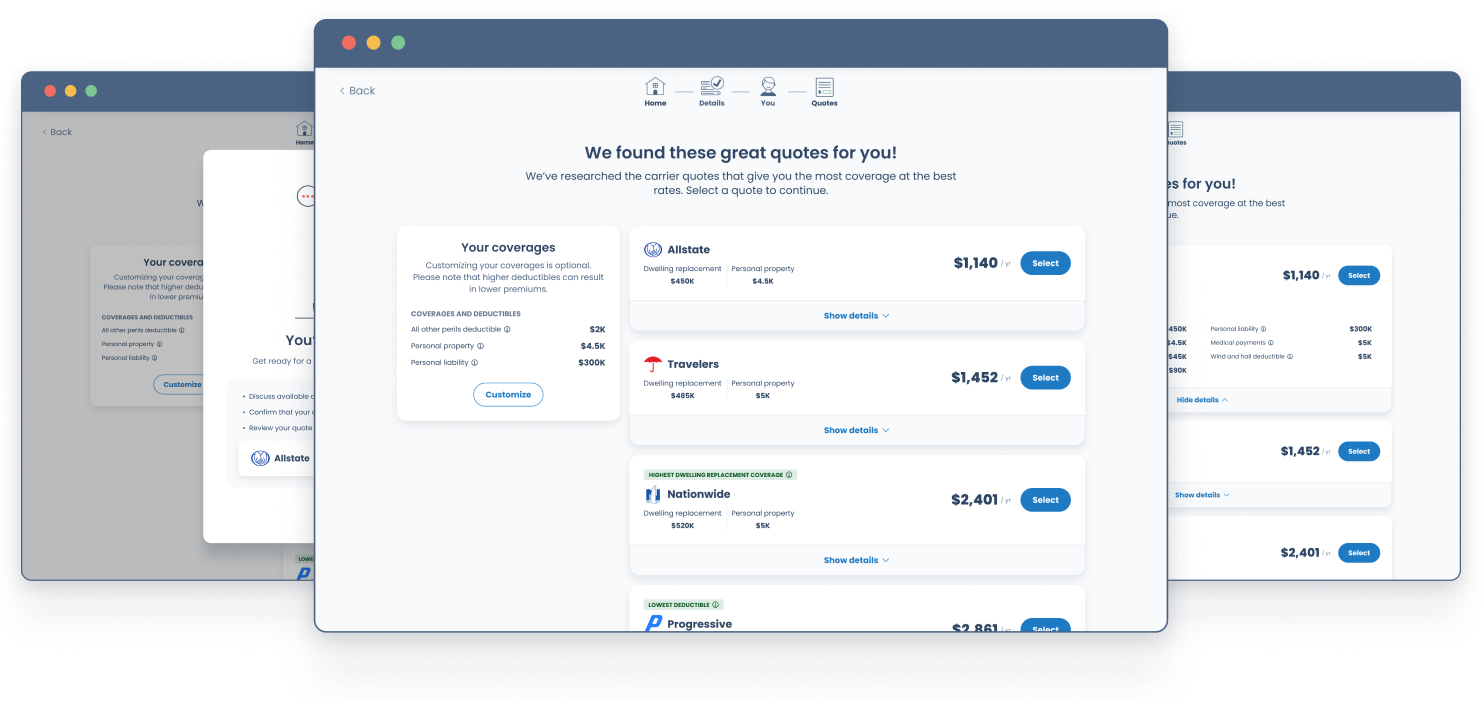

Compare relevant insurance quotes faster than ever.

Lean on experienced VIU by HUB Advisors for guidance and peace of mind.